Some examples on how well VCP Stocks can perform after successful breakout

We are here to show you some examples on the performance after our system detected Volatility Contraction Pattern (VCP) on some India stocks:

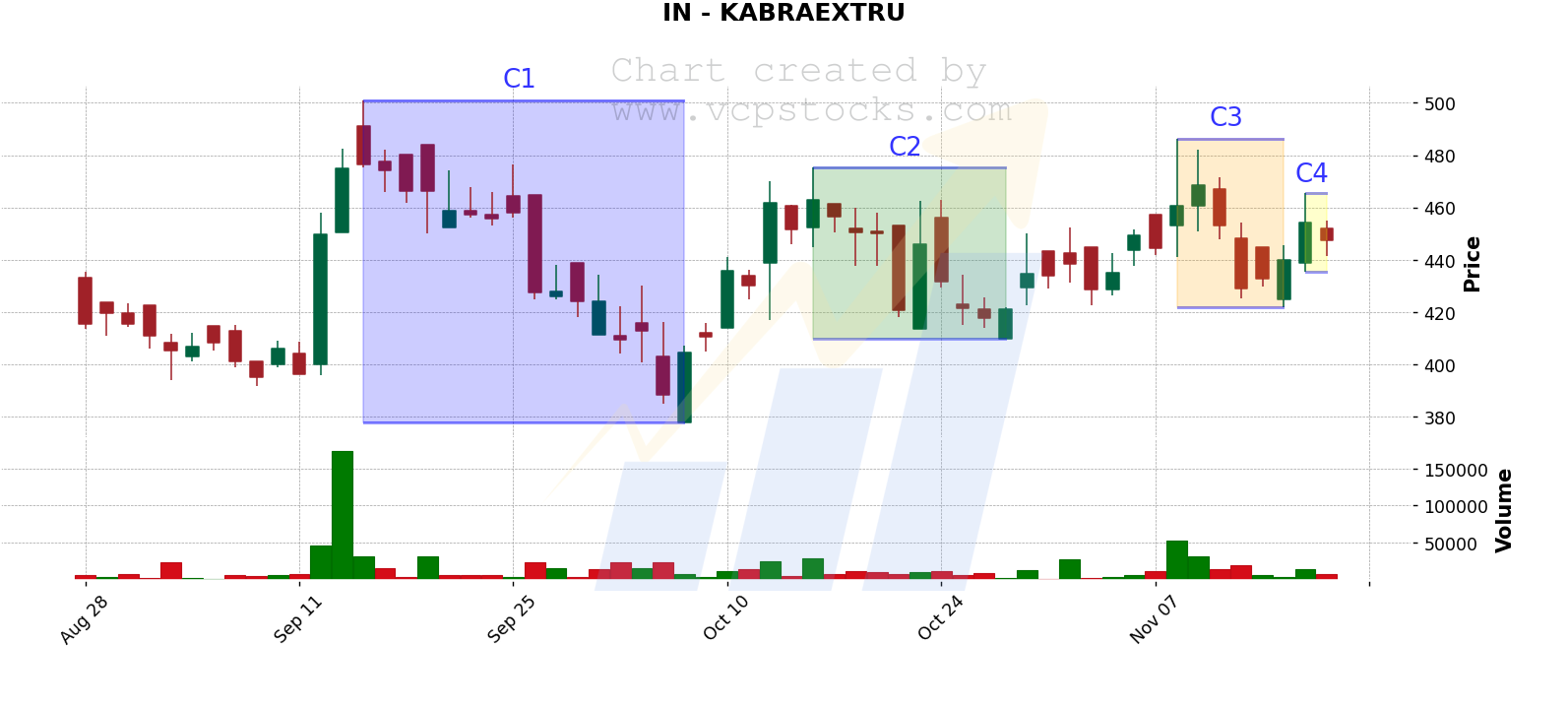

21 Nov 2024

9W-25/6-4T

C4: 465.4-435.3 (6.47% 2024-11-19 to 2024-11-21)

C3: 486.4-422.0 (13.24% 2024-11-08 to 2024-11-18)

C2: 475.5-410.0 (13.77% 2024-10-16 to 2024-10-29)

C1: 501.0-378.0 (24.55% 2024-09-16 to 2024-10-08)

Pivot Point: 465.4

Highest price after breakout (7 days later): 550, +18.18% reward

Highest price after breakout (7 days later): 550, +18.18% reward

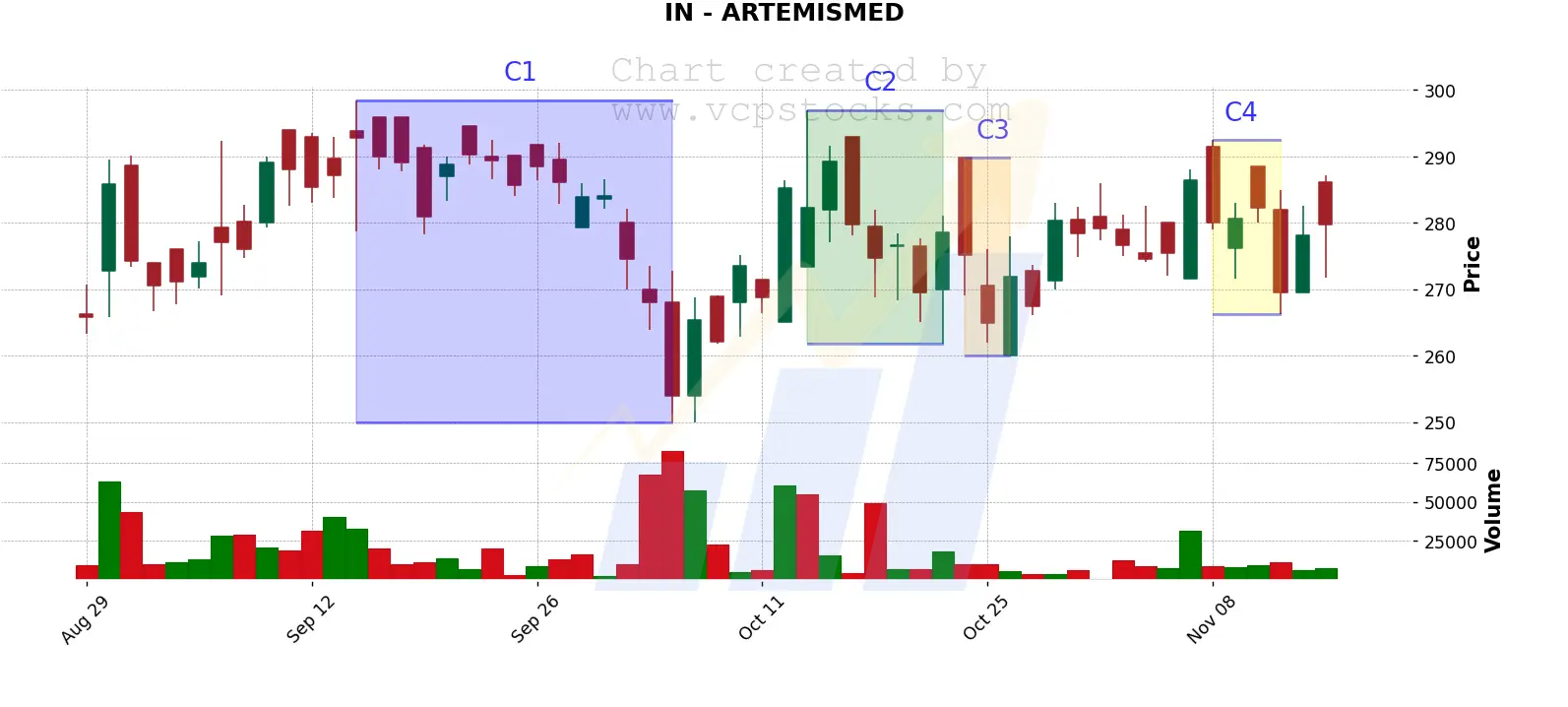

18 Nov 2024

8W-16/9-4T

C4: 292.45-266.25 (8.96% 2024-11-08 to 2024-11-13)

C3: 289.85-260.0 (10.3% 2024-10-24 to 2024-10-28)

C2: 297.0-261.75 (11.87% 2024-10-15 to 2024-10-23)

C1: 298.45-250.0 (16.23% 2024-09-16 to 2024-10-07)

Pivot Point: 292.45 Highest price after breakout (10 days later): 346.95, +18.64% reward

Highest price after breakout (10 days later): 346.95, +18.64% reward

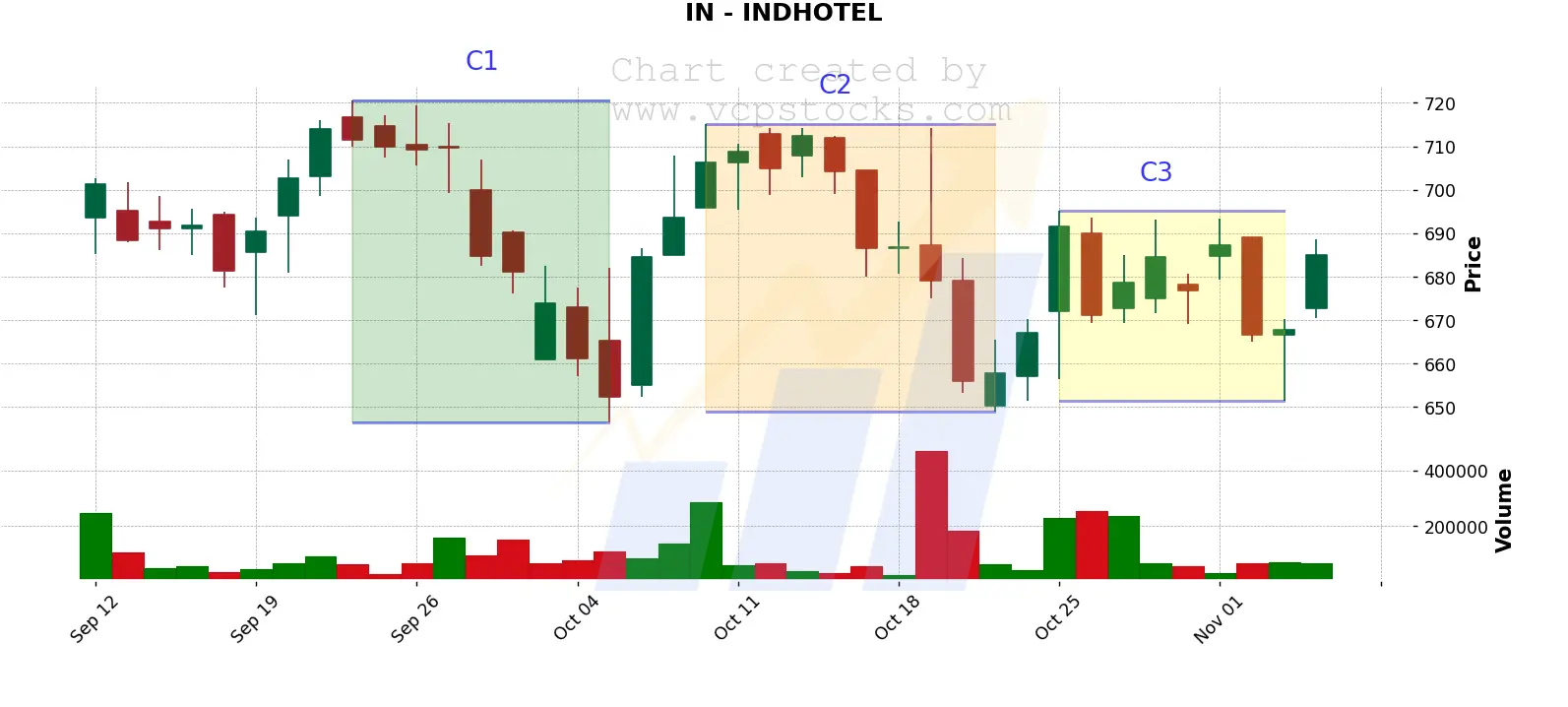

6 Nov 2024

6W-10/6-3T

C3: 695.15-651.35 (6.3% 2024-10-25 to 2024-11-05)

C2: 715.1-648.95 (9.25% 2024-10-10 to 2024-10-23)

C1: 720.6-646.5 (10.28% 2024-09-24 to 2024-10-07)

Pivot Point: 695.15 Highest price after breakout (18 days later): 822.25, +18.33% reward

Highest price after breakout (18 days later): 822.25, +18.33% reward

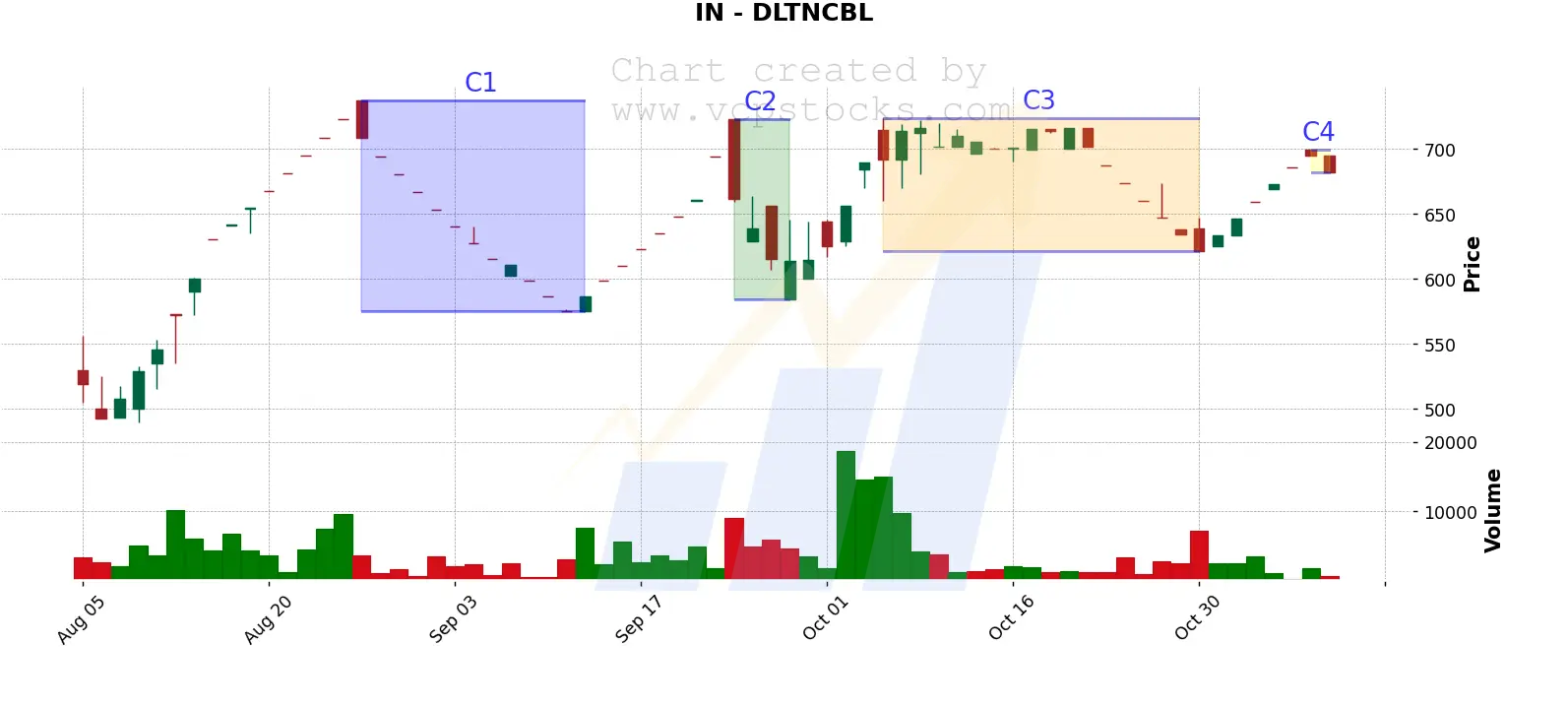

11 Nov 2024

11W-22/3-4T

C4: 699.25-681.5 (2.54% 2024-11-08 to 2024-11-11)

C3: 723.5-621.35 (14.12% 2024-10-07 to 2024-10-30)

C2: 723.0-584.25 (19.19% 2024-09-24 to 2024-09-27)

C1: 737.15-575.0 (22.0% 2024-08-27 to 2024-09-12)

Pivot Point: 699.25 Highest price after breakout (14 days later): 1086, +55.31% reward

Highest price after breakout (14 days later): 1086, +55.31% reward