Ease your pain to screen and find VCP stocks from thousands of US/India stocks.

Subscribe to our Service

Choose the most suitable service plan (Basic or Professional) and make subscription to it.

Receive our Daily VCP stock list email

As long as your subscription is active, you will receive our VCP stock list by email before the stock market start time on each trading date.

Start trading with VCP stocks

Now based on what you understand with VCP, you can fully utilize our VCP stock screen result and make your own trading decisions.

Our system engine will look for Volatility Contraction Pattern (VCP) among all currently active US/India stocks

So many people know the magic power of VCP, but not many people have time to find them out. We are here to help you do this on EVERY trading date!

-

You are ready to beat 90% of the traders on the market!

-

Simply set up a buy stop order above the pivot/breakout point of the VCP stock.

-

Wait for the buy stop order to be triggered. After buying, don't forget to set up a sell stop order on the price just below the last contraction for protection. That's how Mark Minervini tell us!

Magic power of Volatility Contraction Pattern (VCP)

A little recap of what Mark Minervini teach us on his book series "Trade Like a Stock Market Wizard"

In Stage 2 - Uptrend stage

We should not buy any stock that is not in stage 2 (Uptrend stage) even it has Volatility Contraction Pattern (VCP). Don't worry, the VCP stock list we found for you must be in stage 2.

The Line of Least Resistance

This term is defined by legendary trader Jesse Livermore and Mark Minervini keeps using it. In terms of VCP, we should see a movement from greater volatility on the left side of the price base to lesser volatility on the right side. Comparing to the situation where strong investors are replacing weak traders and supply is absorbed. This line of least resistance will be formed once the "weak hands" have been eliminated.

Little buying power results in a great stock price increase

Recall the metaphor by Mark Minervini: Imagine you've soaked a towel in water (selling pressure) and then wrung it out. You need to retwist (contraction) the towel more than 1 time to get all the water all. Finally, the towel become dry and much lighter. At the end, the line of least resistance is formed. With only a little buying power, the stock price can easily go up high.

Entry point with lowest risk

With the above 3 points, it's expected that by waiting for a breakout at the pivot point on the VCP stock, we can easily enjoy a great amount of upward price. With the use of sell stop loss order below the last contraction, we can control our risk to reward ratio.

US - ZIM Integrated Shipping Services Ltd.

Price after breakout (5 days later): 30.15, +18.28% reward

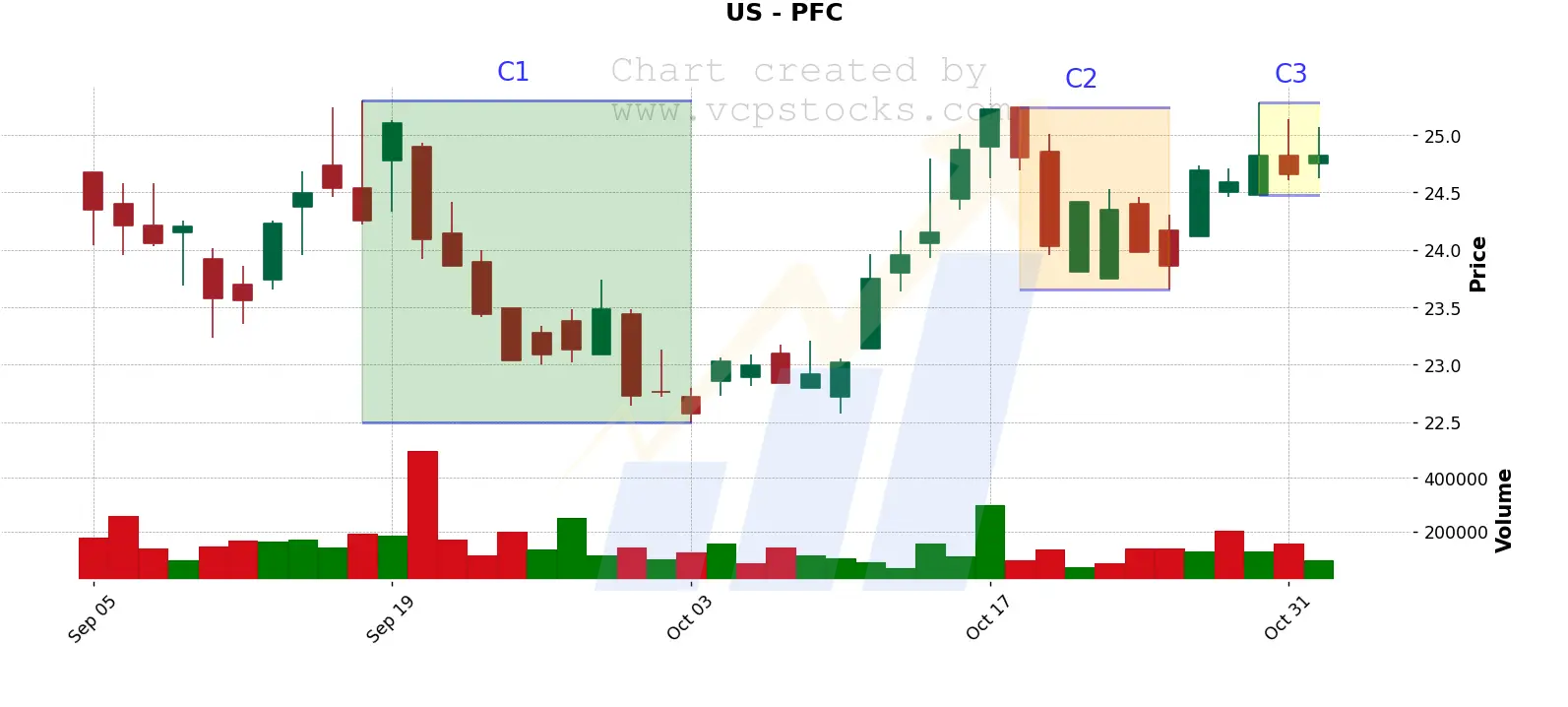

US - Premier Financial Corp.

Price after breakout (6 days later): 29.15, +15.31% reward

US - Parke Bancorp, Inc.

Price after breakout (2 days later): 23.44, +8.52% reward

Subscribe to our service plan now!

- Daily VCP stock charts

- No Weekly VCP stock charts

- Limited to only 1 stock market

- No Stage 2 (Uptrend stage, refer to Mark Minervini's 4 stage analysis) stock list

- No technical analysis & calculation and our customized VCP score rating

- Daily VCP stock charts

- Weekly VCP stock charts

- Access to ALL available stock markets

- Stage 2 (Uptrend stage, refer to Mark Minervini's 4 stage analysis) stock list

- For each VCP stock chart, we offer some technical analysis & calculation we think it's important for you to make a more precise trading decision (Know More)

- VCP score on each stock chart based on our unique system formula to give you insights on how good we rate the chart's setup

- Stock charts delivered directly to your email address

Want to ask something from us?

Now, our platform will only work on the US and India stock market. We hope to extend our services to other stock markets in the future. Please stay tuned.

We accept payment via PayPal as well as Visa, Mastercard, American Express, JCB and China UnionPay credit/debit card.

By subscribing to our service plan, you will need to create an account on our portal. You can manage your subscription status after logging into this portal.

Yes, you can choose to opt out 1 of the market in the setting page after logging into our portal.

You can view Daily VCP stock charts in portal after stock market is closed on each trading day.

For US market, normally, the stage 2 stock list will be ready between 02:00 am and 03:00 am in UTC time from Tuesday to Saturday. And the VCP stock charts will be ready between 05:00 am and 06:00 am in UTC time from Tuesday to Saturday.

For India market, normally, the stage 2 stock list will be ready between 12:00 pm and 01:00 pm in UTC time from Monday to Friday. And the VCP stock charts will be ready between 02:00 pm and 03:00 pm am in UTC time from Monday to Friday.

For US market, you can view Weekly VCP stock charts in portal on each Sunday between 2:00 am and 3:00 am in UTC time.

For India market, you can view Weekly VCP stock charts in portal on each Sunday between 6:00 am and 7:00 am in UTC time.

We get the raw stock data from well known website TradingView to draw our own VCP stock charts from these data. Therefore, the data is trustworthy and the charts are accurate.

For US stocks, it covers ticker symbols that are listed in TradingView's screener (filtered by market = US, exchange = NASDAQ and NYSE).

For India stocks, it covers ticker symbols that are listed in TradingView's screener (filtered by market = Inida, exchange = BSE).

Remark: We will exclude ETF, Index Fund and Market Index ticker symbols.